Robotic Warehouse Automation, Explained by Process

AMRs, AGVs, Conveyors. What actually gets automated. Who builds it. When it makes sense. How Amazon, Walmart, and UPS Actually Use AMRs, AGVs, and Conveyors

Most warehouse automation failures don’t come from bad robots.

They come from automating the wrong process first.

Companies like Amazon, Walmart, UPS and DHL didn’t wake up one day and decide to “add robotics.” They reacted to specific failures. Bottlenecks at inbound docks. Picking that couldn’t scale. Packing lines that quietly eroded margins.

Warehouse automation isn’t a single project. It’s a sequence of decisions tied to flow, data, and constraints.

That sequence is what this article follows. Dock to door.

Why Automation Is No Longer Optional

Warehouses are being squeezed from both sides. Labor is harder to hire and harder to retain. At the same time, customer expectations keep compressing delivery windows.

This shift changed how leading operators think about automation. It’s no longer a cost-cutting experiment. It’s operational risk management.

Large retailers and 3PLs now design automation to do three things:

Stabilize throughput during demand spikes

Reduce dependency on fragile labor availability

Make performance predictable, not heroic

The key insight from enterprise operators is simple. Efficiency starts with foundations. Clean data. A reliable WMS(Warehouse Management System). Aligned processes. Only then does automation amplify results, a point reinforced repeatedly in large-scale warehouse playbooks and enterprise automation guides.

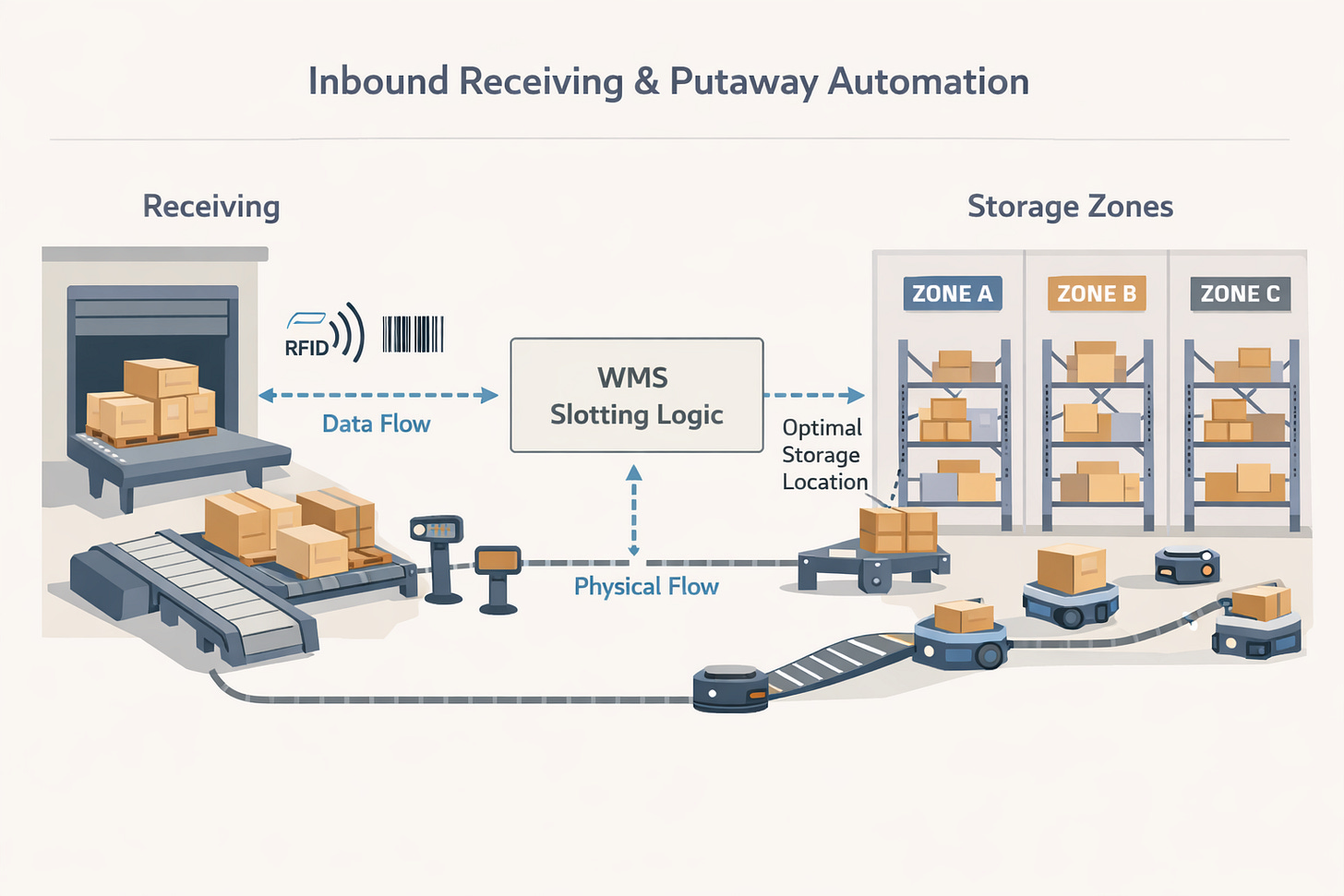

1. Inbound Receiving and Putaway Automation

What Gets Automated

Inbound receiving, inspection, barcode scanning, data validation, and putaway routing.

This happens at the dock. It’s not flashy. It’s also where small delays cascade into stockouts, missed orders and late shipments.

How Leaders Actually Do It

In Amazon fulfillment centers, inbound cartons are scanned immediately at receiving. Those scans validate purchase orders inside the WMS in real time. If something doesn’t match, the system flags it before the item ever touches storage.

From there, goods don’t wander the warehouse. Conveyors or AMRs(Autonomous Mobile Robots) move them directly to assigned zones based on slotting logic and demand heat maps.

Walmart distribution centers follow a similar pattern, especially for high-volume retail replenishment. Conveyor-fed receiving lanes keep flow predictable. For mixed-SKU inbound, mobile robots handle transport to staging zones.

DHL often layers RFID into this step for regulated or high-velocity operations. Contactless reads allow faster receiving without line-of-sight scanning, which matters when inbound volumes spike.

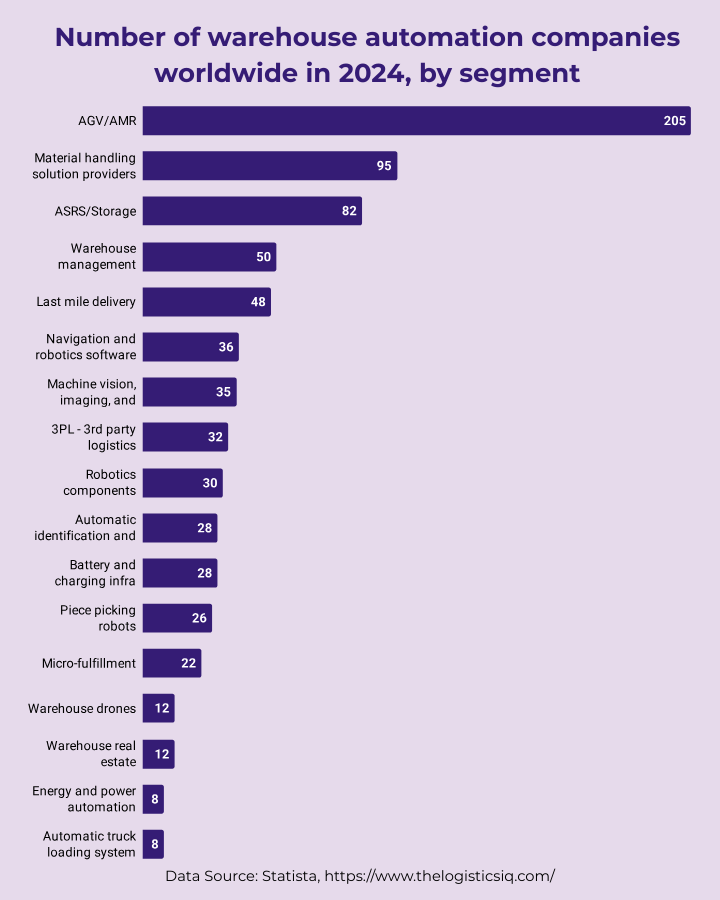

Who actually builds this

GreyOrange builds AMRs tightly coupled with AI-driven orchestration software. In inbound operations, their systems decide not just how inventory moves, but where it should live based on forecasted demand and turnover. Putaway becomes a dynamic decision, not a static rule.

Geek+ focuses on high-throughput material transport using AMRs. In inbound workflows, their robots move cartons and totes from receiving to staging or storage zones without fixed infrastructure, which makes them popular in fast-scaling e-commerce warehouses.

Vecna Robotics approaches inbound from a workflow perspective. Their AMRs integrate deeply with WMS and ERP systems, allowing dock-to-stock automation that adapts to congestion, task priority, and labor availability.

Time and cost

Deployment typically takes 4 to 8 weeks. Costs range from $100,000 to $500,000 depending on scale and integration depth.

KPI impact

Receiving accuracy improves. Putaway time per unit drops. Dock cycle time shortens.

Where it makes sense

Mid to large distribution centers. E-commerce fulfillment. Any operation with frequent inbound shipments.

Typical stack:

Handheld or fixed barcode scanners

Optional RFID readers

WMS-driven validation and routing

Conveyors or AMRs for transport

2. Order Picking Automation

Why Picking Breaks First

Picking is where labor hours disappear. It’s walking. It’s searching. It’s fatigue-driven errors.

That’s why most large warehouses focus here early. Not to remove people, but to remove waste.

How It’s Done in Practice

Amazon’s approach popularized goods-to-person workflows. Instead of people walking miles per shift, robots bring inventory to stationary workers. Productivity rises because motion is eliminated, not because humans are replaced.

Walmart takes a hybrid approach. Fast-moving SKUs get automated assistance. Long-tail items often remain manual but guided through pick-to-light or pick-to-voice systems

Many systems on the market today intertwine robotic processes with processes that collaborate with humans. For example, a person needs to be present at their station to maintain picking flow or a person needs to be present in the aisle to pick goods for a traveling robot.

In the 3PL world, flexibility matters more than perfection. DHL and similar operators batch orders intelligently so AMRs and humans work together. Robots handle transport. People handle judgment.

Who actually builds this

Locus Robotics builds collaborative AMRs that travel with pickers. Their value isn’t speed alone. It’s flexibility. Warehouses can deploy robots without re-laying floors or rebuilding layouts, which is why they show up so often in brownfield sites.

6 River Systems combines navigation, pick guidance, and task prioritization into a single mobile unit. Their systems shine where fast deployment matters more than deep customization.

Exotec goes further into goods-to-person automation. Their robots retrieve bins from dense storage and deliver them directly to pick stations, blending storage and picking into one continuous flow.

Time and cost

Deployment ranges from 3 to 6 months. Costs start around $200,000 and can exceed $2 million for high-throughput systems.

Common tools:

Pick-to-light or pick-to-voice systems

AMRs(Autonomous Mobile Robots) or AGVs(Autonomous Ground Vehicles) for goods-to-person

WMS(Warehouse Management System) logic for batch, wave, or zone picking

KPIs That Improve

Picks per hour increase

Order accuracy improves

Labor cost per order drops

3. Packing and Sorting Automation

What Gets Automated

Carton forming, weighing, dimensioning, labeling, and routing packages to the correct outbound lane.

This stage quietly controls shipping cost and customer satisfaction.

How High-Volume Warehouses Run It

Amazon and Walmart both rely heavily on automated dimensioning and inline weighing. Every parcel is measured. The system selects the right carton and carrier automatically.

From there, conveyor-based sortation takes over. Tilt-tray and cross-belt sorters route packages to the right dock door or carrier lane at speed and with consistency.

DHL hubs use similar systems to handle multi-carrier outbound flows without manual decision-making at pack-out.

Typical technologies:

Automated cartonizers

Inline scales and dimensioners

Print-and-apply labelers

Conveyor-based sortation systems

Who actually builds this

Dematic designs large-scale conveyor and sortation systems that serve as the backbone of outbound operations. Their strength is systems integration, not individual machines.

TGW delivers tightly integrated packing and sortation lines where software control and physical flow are designed together. This reduces handoffs and error points.

Vanderlande specializes in high-speed sortation, particularly for parcel and omnichannel environments where throughput variability is extreme.

Time and cost

Deployment takes 2 to 5 months. Costs range from $500,000 to $5 million depending on throughput.

KPIs That Shift

Packing speed increases

Shipping errors decline

Cost per package drops

4. Inventory Visibility and Real-Time Tracking

Why Automation Fails Without Data

Robots don’t fix bad inventory data. They amplify it.

Inaccurate inventory leads to stockouts, excess safety stock, and missed promises.

What Leading Operations Use

RFID is common in apparel, pharma, and electronics. Fixed readers at gates and zones update inventory automatically as goods move.

Some warehouses deploy inventory drones or autonomous robots for cycle counting. Counts happen more often, without shutting down aisles or pulling labor.

Integrated properly, inventory data flows directly into the WMS or ERP and becomes actionable.

Typical setup:

RFID tagging and fixed readers

Vision systems or inventory drones

IoT-enabled WMS

Who actually builds this

Verity builds autonomous indoor drones that scan inventory at height. Cycle counting becomes continuous instead of disruptive.

Gather AI focuses on turning inventory counting into a data stream. Their systems prioritize accuracy without warehouse downtime.

Dexory combines mobile robots, sensors, and cloud software to create real-time digital twins of inventory and space utilization.

Time and cost

Deployment takes 8 to 16 weeks. Costs range from $100,000 to $1 million depending on coverage.

KPIs That Improve

Inventory accuracy increases

Cycle counts become frequent

Stockouts decrease

5. Automated Storage and Retrieval Systems (AS/RS)

When AS/RS Makes Sense

Dense storage. Space constraints. High SKU variety.

These systems trade flexibility for efficiency. That trade only works when space is the real bottleneck.

How Big Operators Think About It

Neither Amazon nor Walmart deploy AS/RS everywhere. They use it selectively. Cold storage. Pharma. Urban fulfillment centers where floor space is expensive.

Once installed, layouts are fixed. Downtime is costly. ROI takes time.

Common systems:

Shuttle-based AS/RS

Mini-load cranes

Vertical lift modules

Who actually builds this

AutoStore pioneered cube-based AS/RS systems that maximize space efficiency. Robots retrieve bins from dense grids and deliver them to workstations.

Symbotic builds AI-driven, high-density storage and robotic pallet handling systems for large-scale distribution environments.

Swisslog provides crane- and shuttle-based AS/RS solutions, especially in regulated industries where precision and traceability are mandatory.

Time and cost

Deployment takes 6 to 12 months. Costs range from $500,000 to over $10 million.

KPIs That Change

Storage density increases

Retrieval time decreases

Inventory holding cost drops

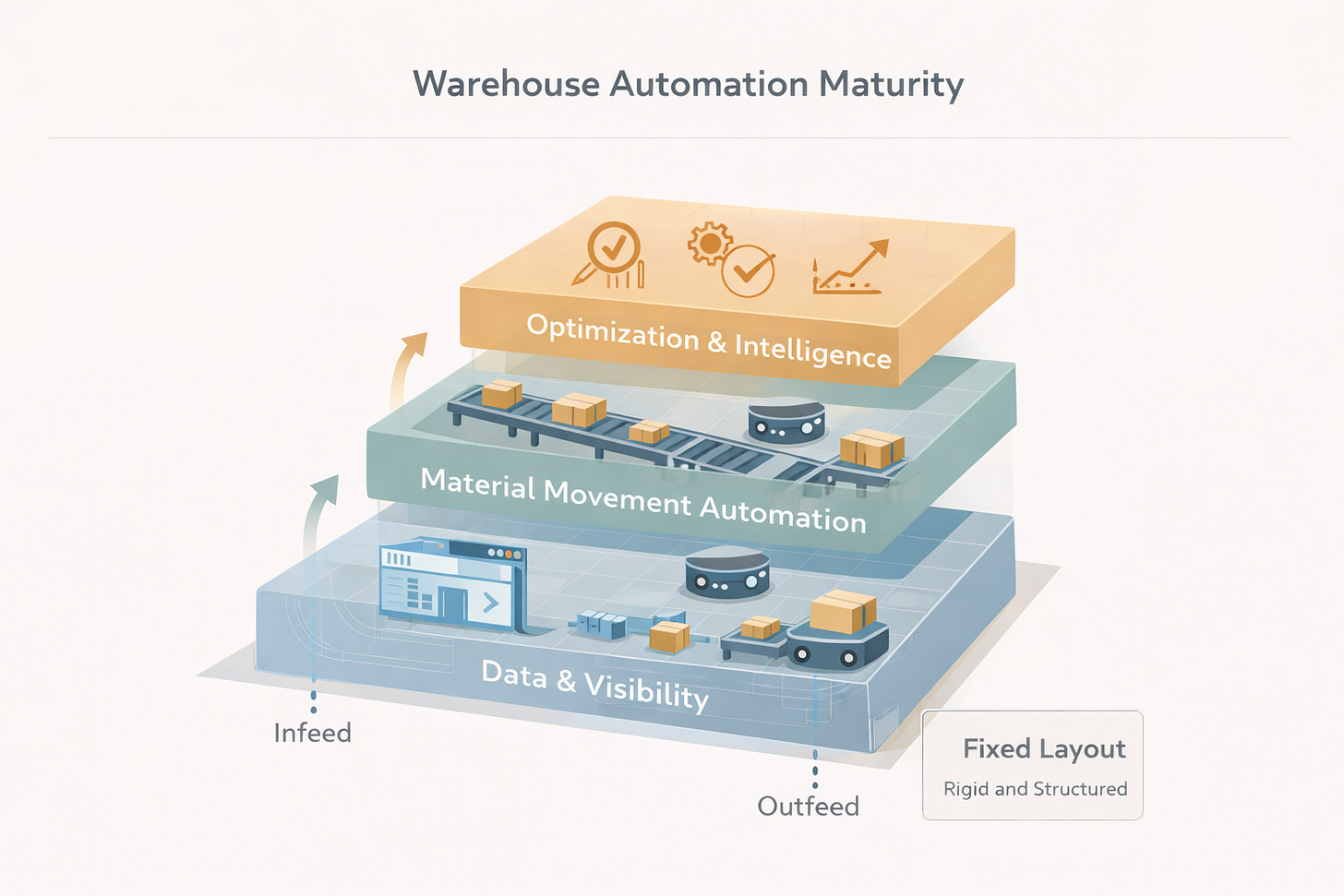

6. How Leading Companies Phase Automation

A pattern shows up again and again across enterprise operators and 3PLs.

They don’t automate everything at once.

They start with:

Data capture and visibility

Material movement

Intelligence and optimization

Amazon didn’t leap straight to full automation. Neither did Walmart or DHL. They piloted. Learned. Scaled deliberately.

This phased approach shows up consistently in enterprise warehouse efficiency playbooks and AMR ROI analyses from operators running hundreds of sites.

The Mistake Most Automation Projects Make

They start with tools instead of flow.

They underestimate integration and change management.

They treat vendors as equipment suppliers, not system partners.

Robots don’t fail warehouses. Bad system design does.

Final Thought

Warehouse automation reshapes logistics only when it aligns with SKU mix, order profiles, labor realities, and growth plans.

AMRs, AGVs, conveyors, and AS/RS are tools.

Flow is the strategy.

If you want deeper breakdowns like this. Real systems. Real tradeoffs. No hype. Subscribe to the newsletter. You can also reach out for personalized help and questions on robotic systems and hardware product management

Disclaimer: Generative AI has been used to generate images used in this work. Examples referenced are illustrative of common automation patterns and not endorsements and are not promotions or advertisement. Many of the robot maker solutions also do overlap across functions

Reference and Additional materials